Management Policy

Mid-term Management Policy

As of June 20, 2025

Mid to long term Management Strategy

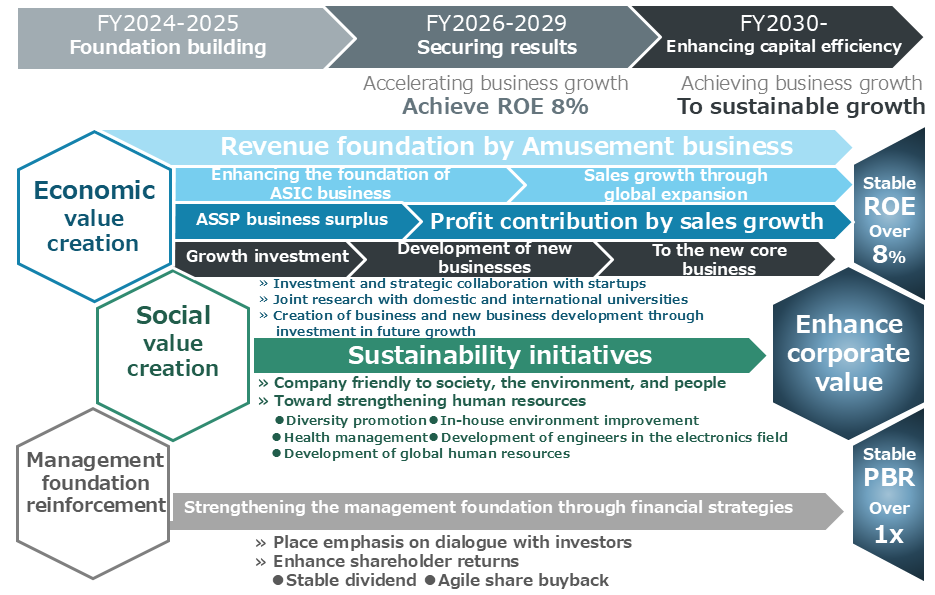

The MegaChips Group is committed to creating high-value-added products and services by combining the proprietary technologies that the Company has cultivated with the innovative, cutting-edge technologies and expertise of other companies. The Company aims to provide solutions that address its customers' challenges. While strengthening the business foundation of its core amusement business, the Company will focus its management resources on growth markets such as industrial equipment and communication devices. Through the expansion of our ASIC and ASSP business and the development of new businesses, the Company will drive the transformation of its business structure.

In the medium to long term, the Company plans to strengthen its business portfolio by focusing on three core pillars: the amusement business, the ASIC business, and the ASSP business, each with distinct business models. At the same time, the Company will dedicate efforts to nurturing new businesses that will drive the next generation, aiming to enhance its growth potential and reinforce its revenue structure.

For each business, the Company will not only expand domestically but also actively promote overseas development, particularly in North America and Asia. The goals include acquiring new technologies, integrating them with its proprietary technologies, creating solutions using cutting-edge technologies, and exploring new markets and customers. To achieve these objectives, the Company will pursue joint research and development with universities both domestically and internationally, as well as invest in and form strategic partnerships with startup companies that possess advanced technologies and innovative ideas. Through these initiatives, the Company aims to create and commercialize unique businesses.

Additionally, the Company will promote initiatives for sustainability management as a socially, environmentally, and human-friendly organization, while implementing measures such as creating a comfortable work environment, fostering diversity, advancing health management practices, and supporting the development of engineers in the electronics field as well as global talent. The Company will prioritize dialogue with investors while enhancing shareholder returns through stable dividends and agile share buybacks, thereby further enriching return to shareholders.

The Company aims to enhance corporate value by steadily implementing its managerial strategies. As part of its medium- to long-term vision, the Company targets achieving an ROE of 8% or higher as a target to improve profitability and capital efficiency. Additionally, the Company will strive to attain a PBR of 1x or higher as a market valuation target, ensuring sustained growth and increased market recognition.

- Amusement Business

In the core amusement business, the Company will continue to enhance customer-focused proposal activities and support systems to further improve our services. At the same time, to secure market share and ensure a stable supply of products, the Company will strengthen information sharing and production systems with partner companies and manufacturing contractors. By working to solidify the entire supply chain, the Company aim to further establish our position as a key supplier and ensure stable sales and revenue. - ASIC Business

In the ASIC business, in addition to the existing focus on consumer electronics and office

automation equipment, new growth targets have been identified in the industrial equipment and

communication infrastructure sectors. Efforts will continue to expand the business in these areas. Moving forward, the expertise developed over the years in upstream design and analog technologies - particularly strengths in communication interface technology, security technology, and image processing technology - will be leveraged to develop products for image-related equipment, factory automation (FA) equipment, and communication infrastructure devices, with plans to gradually move these products into mass production.

Simultaneously, efforts will be intensified to expand market presence and secure business

opportunities not only in Japan but also in overseas markets, particularly in North America and Asia. These initiatives aim to achieve sustainable revenue and profit growth over the medium to long term. - ASSP Business

In the ASSP business, efforts are underway to advance the full-scale mass production of

communication solutions through a strategic partnership with Australia's Morse Micro. This

communication business leverages the wired communication technologies developed by the company over the years, combined with Morse Micro's wireless communication technology, which achieves an exceptionally long communication range of approximately 1 km and low power consumption. By providing LSIs and modules, the business aims to deliver a wide range of communication solutions tailored to customer needs. - Management that is conscious of cost of capital and stock price

MegaChips Groups aims to achieve both high capital efficiency and sound financial structure. The Company will allocate managerial resources appropriately , taking into account market conditions, competitive circumstances, and growth opportunities.

Regarding capital efficiency, the Company strives to fully understand its cost of capital and take initiatives that align with this cost to enhance corporate value over the medium to long term. The Company considers Return on Equity (ROE) and PBR (Price-to-Book Ratio) as key indicators, representing capital profitability relative to equity and market valuation, respectively. By adopting a management approach that is conscious of capital costs, we aim to enhance corporate value over the medium to long term. Currently, MegaChips Group’s ROE is below the level of its recognized cost of capital. To address this, the Company has set a target ROE level of 8% or higher, and we will continue to improve capital efficiency and steadily execute medium- to long-term management strategies to enhance profitability and achieve this target.

In addition to improving capital efficiency, the Company will enhance opportunities for communication, such as individual IR meetings with institutional investors, to promote constructive dialogue and gain understanding regarding management strategies. Furthermore, the Company will share the opinions and requests obtained through these dialogues internally and utilize them in considering future initiatives. Additionally, the Company will actively disseminate non-financial information through its website and other channels, striving to provide information that serves as a basis for dialogue with investors.

Sustainability Initiatives

In order to realize a more prosperous, secure, and sustainable society, our group, as “company friendly to society, the environment, and people”, will address various issues such as compliance with laws, regulations, and social norms; contribution to society by providing excellent products; respect for human rights and promotion of diversity; fair trade with suppliers and business partners; respect for stakeholders; and contribution to global environmental conservation.

- Promoting human resources development and improving working environment

To bring the best out of our human resources, we will promote the development of human

resources and diversification and improve the work environment. As to the human resource

development and diversification, we will expand on education system, such as job-level training and theme-based training, employ a wide variety of people through a year-round recruitment system, development of global talent, enhance internship opportunities in our new graduate recruitment activities. We will also strive to create a comfortable working environment for all employees by conducting stress checks and workshops on women's health and encouraging employees to take paid leave. - Addressing environmental conservation

For global environmental conservation, the MegaChips Group will operate its business taking into consideration countermeasures for global warming and reduction of the environmental load. In research and development, we will continue to promote environmentally friendly product

manufacturing by enhancing the functions and quality of LSI, focusing on high-speed processing, downsizing, and low-power consumption. We will also engage in activities to reduce energy consumption and waste in our offices. Regarding outsourcing manufacturers, we continuously strive to establish a sustainable supply chain by requesting compliance with the policy on the use of hazardous materials and adherence to carbon dioxide and hazardous material emission standards. - Social contribution activities

To support the younger generation, which is the foundation of Japan’s strength, we are dedicated to developing highly skilled human resources who will lead the next generation in the electronics field through donations to Japanese universities and joint or outsourced research, while, at the same time, promoting the creation of innovative technologies through research activities. In addition to supporting women's universities as part of our efforts to nurture talented female engineers of the future, we began providing financial support through a non-repayable scholarship, the "MegaChips Corporation Scholarship for Female Students in Science," starting in FY2024. This initiative aims to promote the diversification of engineers in the electronics field.

Related Links