Stock Information

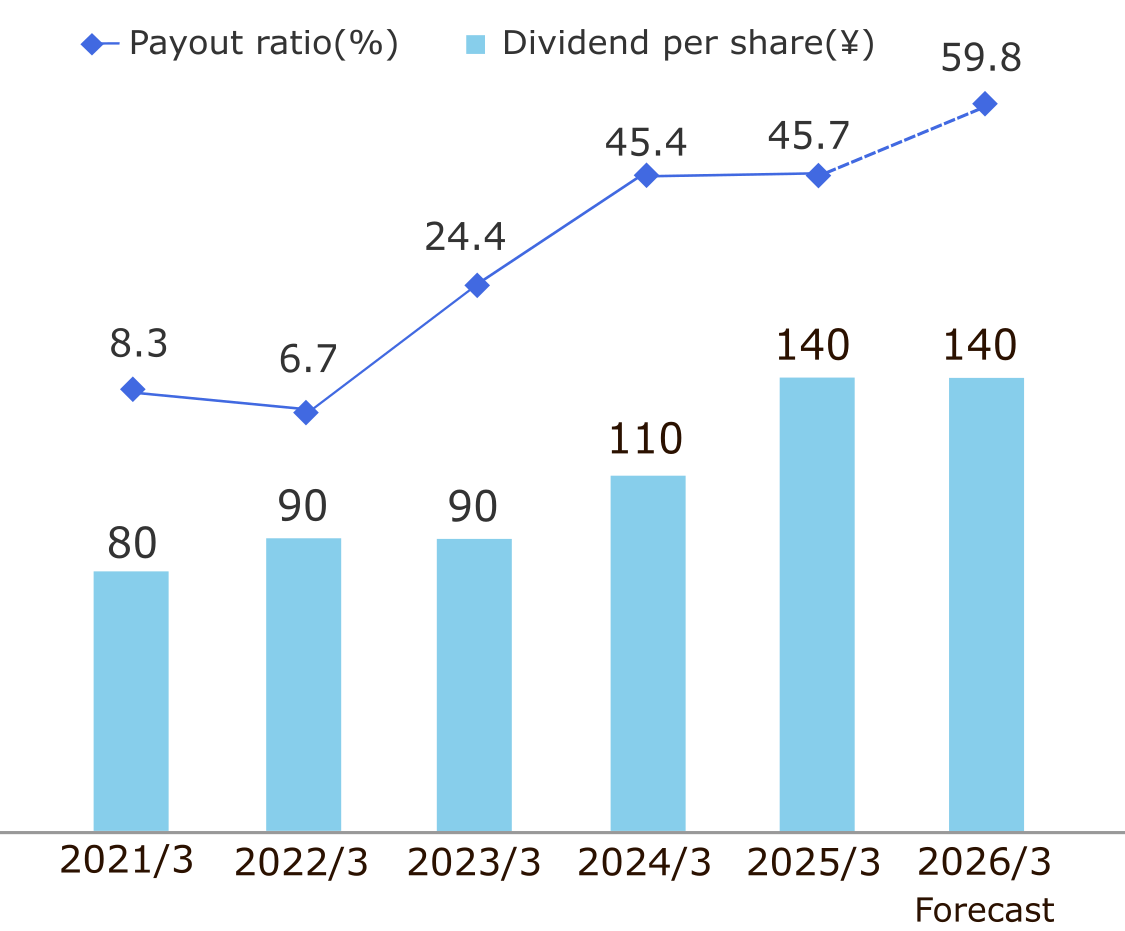

Dividends

Shareholder Returns (Dividends)

As of December 17, 2025

The Company decided to pay an annual dividend of ¥140 per share for the fiscal year ended March 2025 based on the policy regarding the distribution of earnings.

In addition, regarding dividends for the fiscal year ending March 2026, we expect to pay an annual dividend of ¥250.

Basic Profit Distribution Policy

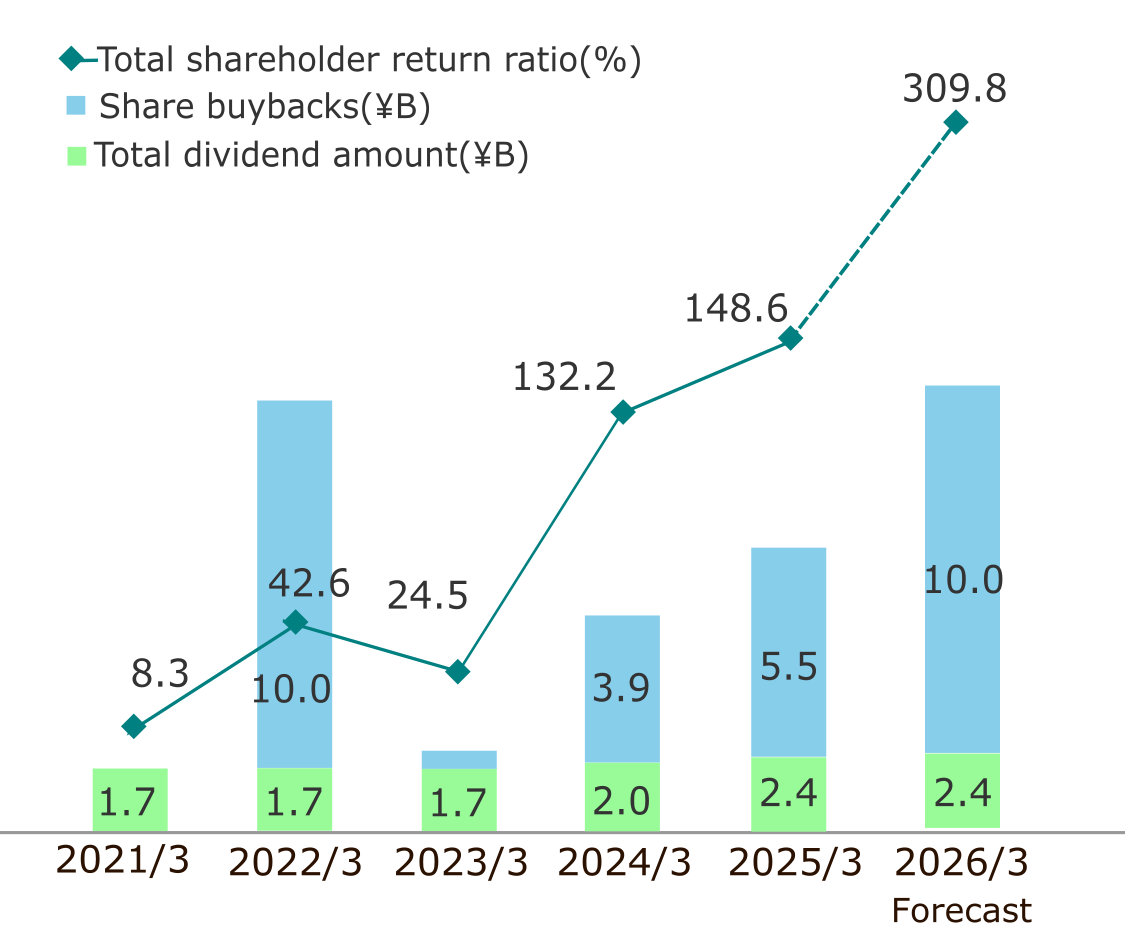

The Company aggressively promotes shareholder returns, while taking into consideration the Company's business outlook, to better achieve both the sustainable return of profits and the growth of the Company. Its basic policy is as follows:

- The Company will determine the amount of dividends by taking an amount equivalent to at least 30% of the consolidated net income attributable to owners of parent (with special factors relating to accounting, financial settlement or taxation added or subtracted upon due consideration) as the aggregate amount of dividends, while taking the medium-term business outlook into consideration, and dividing this amount by the number of shares that have been issued at the end of the period, minus the number of shares held by the Company at the end of the period.

- Aiming at sustainable improvements in its corporate value, the Company will allocate funds to fundamental research to create innovative new technologies, the development of unique products, the achievement of a suitable business portfolio, and the securing of competent human resources to achieve medium-to long-term growth. It will also give consideration to maintaining a sound financial position that can withstand variations in the business environment.

- The Company shall endeavor to return profits to shareholders by acquiring its own shares expeditiously, taking into consideration such factors as market conditions, movements of stock prices, and the Company's financial circumstances in order to improve the efficiency of capital.

In accordance with the Articles of Incorporation approved at the 16th Ordinary General Meeting of Shareholders held on June 23, 2006 and Article 459(1) of the Companies Act, decisions regarding the distribution of dividends shall be made via a resolution by the Board of Directors, without requiring a resolution by a General Meeting of Shareholders, unless otherwise stipulated by law.

Dividends shall be distributed once every year to those Shareholders or Registered Pledgees of Shares listed or registered in the final shareholder registry as March 31 of every year. However, dividends may be distributed by prescribing a different record date, following a resolution by the Board of Directors in accordance with the Companies Act and the Articles of Incorporation.

We will implement shareholder returns and a dividend forecast based on above policy and details will be announced as they are decided.

Share Repurchases

| Resolution | Results | ||||

| Release Date | Total maximum number of purchaseble shares (Thousands) |

Total maximum amount of repurchase cost (Millions of yen) |

Total number of shares repurchased (Thousands) |

Total amount of repurchase cost (Millions of yen) |

Purchase period |

| 2025/5/14 | 1,700 | 10,000 | 1,605 | 9,999 | From May 15, 2025 to December 11, 2025 |

| 2024/8/20 | 1,000 | 4,500 | 829 | 4,499 | From August 21, 2024 to January 14, 2025 |

| 2024/2/9 | 480 | 2,000 | 480 | 1,889 | From February 13, 2024 to May 17, 2024 |

| 2023/3/22 | 1,200 | 3,000 | 835 | 2,999 | From March 23, 2023 to July 31, 2023 |

| 2021/11/17 | 1,500 | 5,000 | 1,070 | 4,999 | From November 18, 2021 to February 1, 2022 |

| 2021/5/14 | 1,600 | 5,000 | 1,542 | 4,999 | From May 17, 2021 to September 3, 2021 |

The Company has conducted share repurchases prior to FY 2020.

For details of those past transactions, please refer to the archive of IR releases.

Information regarding the ongoing share repurchase will be posted on this page once it has been completed ( i.e., when the repurchase period ends or the maximum number of shares or total amount has been reached).